Cyber insurance is a type of insurance that protects businesses from financial losses that can result from a cyberattack. While it’s an essential tool for businesses of all sizes, there are some facts you should be aware of before purchasing a policy.

Just because you have cyber insurance, it doesn’t mean you are guaranteed a payout in the event of an incident. This is because you may not have the correct coverage for certain types of cyberattacks or you might have fallen out of compliance with your policy’s security requirements. As a result, it is critical to carefully review your policy and ensure that your business is adequately protected.

Learn from the past

Even though these examples are from the United States, it could easily happen in Canada as well. Here are three real-life examples of denied cyber insurance claims:

Cottage Health vs. Columbia Casualty

The issue stemmed from a data breach at Cottage Health System. They notified their cyber insurer, Columbia Casualty Company, and filed a claim for coverage.

However, Columbia Casualty sought a declaratory judgment against Cottage Health, claiming that they were not obligated to defend or compensate Cottage Health because the insured didn’t comply with the terms of their policy. According to Columbia Casualty, Cottage Health agreed to maintain specific minimum risk controls as a condition of their coverage, which they then failed to do.

This case reminds organizations of the importance of reading their cyber policy, understanding what it contains and adhering to its terms.

BitPay vs. Massachusetts Bay Insurance Company

BitPay, a leading global cryptocurrency payment service provider, filed a $1.8 million insurance claim, but Massachusetts Bay Insurance Company denied it. The loss was caused by a phishing scam in which a hacker broke into the network of BitPay’s business partner, stole the credentials of the CFO of BitPay, pretended to be the CFO of BitPay and requested the transfer of more than 5,000 bitcoins to a fake account.

Massachusetts Bay Insurance stated in its denial that BitPay’s loss was not direct and thus was not covered by the policy. Massachusetts Bay Insurance asserted that having a business partner phished does not count as per the policy.

Although BitPay is appealing the denial, this case emphasizes the importance of carefully reviewing insurance policies to ensure you understand what scenarios are covered. This incident also highlights the importance of employee security awareness training and the need to reach out to an IT service provider if you don’t have a regular training policy.

International Control Services vs. Travelers Property Casualty Company

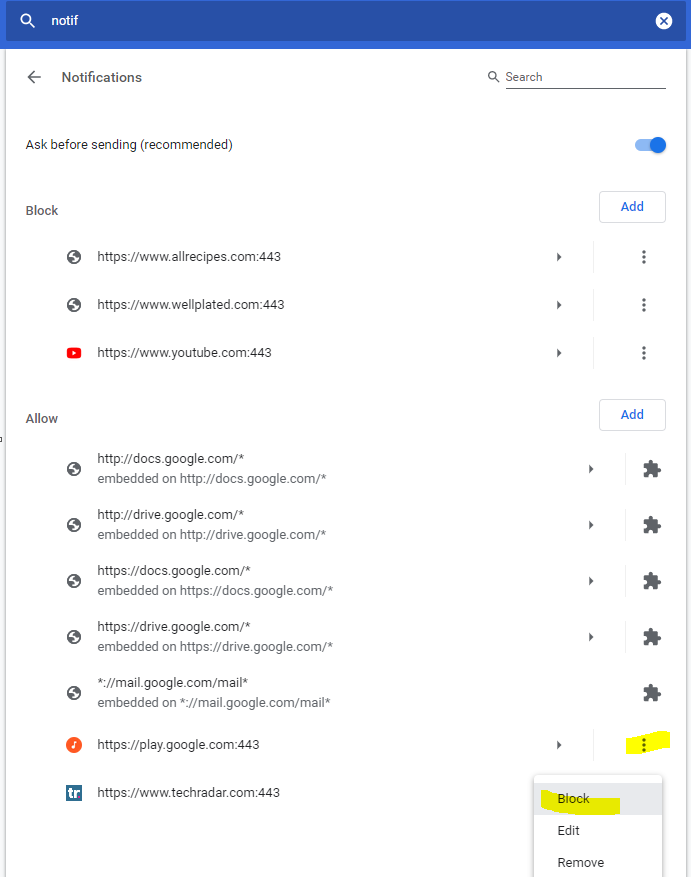

Travelers Property Casualty Company requested a district court to reject International Control Services’ ransomware attack claim. The company argues that International Control Services failed to properly use multifactor authentication (MFA), which was required to obtain cyber insurance. MFA is a type of authentication that uses multiple factors to confirm a user’s identity.

Travelers Property Casualty Company claims that International Control Services falsely stated on its policy application materials that MFA is required for employees and third parties to access email, log into the network remotely and access endpoints, servers, etc. They stated that International Control Services was only using the MFA protocol on its firewall and that access to its other systems, including its servers, which were the target of the ransomware attack in question, were not protected by MFA.

This case serves as a reminder that when it comes to underwriting policies, insurers are increasingly scrutinizing companies’ cybersecurity practices and that companies must be honest about their cybersecurity posture.

Travelers Property Casualty Company said it wants the court to declare the insurance contract null and void, annul the policy and declare it has no duty to reimburse or defend International Control Services for any claim.

Don’t be late to act

As we have seen, there are several reasons why businesses can be denied payouts from their cyber insurance policies. Sometimes, it could be due to a naive error, such as misinterpreting difficult-to-understand insurance jargon. In other cases, businesses may be maintaining poor cybersecurity hygiene.

Claritech Solutions can help you avoid these problems by working with you to assess your risks and develop a comprehensive cybersecurity plan. Feel free to reach out for a no-obligation consultation.

To learn more about cyber insurance, download our infographic titled “What Every Small Business Needs to Know About Cyber Insurance” by clicking here.

Memory is next. I like to get a minimum of 8 GB and 16 GB is ideal these days. You can get away with 4 GB if it’s starting to get too expensive and the memory is upgradeable. It’s almost always cheaper to add memory later than it is to buy an upgrade from Dell. Before committing to a purchase, make sure the memory can be upgraded. Some smaller laptops only have room for one or two sticks. If you purchase a laptop and the slots are full, you’ll have to throw the existing sticks away to upgrade. Even worse, some models of laptops don’t even allow for memory or hard drive upgrades. If upgrades aren’t possible, make sure you get 16 GB if you want your laptop to last more than a couple of years.

Memory is next. I like to get a minimum of 8 GB and 16 GB is ideal these days. You can get away with 4 GB if it’s starting to get too expensive and the memory is upgradeable. It’s almost always cheaper to add memory later than it is to buy an upgrade from Dell. Before committing to a purchase, make sure the memory can be upgraded. Some smaller laptops only have room for one or two sticks. If you purchase a laptop and the slots are full, you’ll have to throw the existing sticks away to upgrade. Even worse, some models of laptops don’t even allow for memory or hard drive upgrades. If upgrades aren’t possible, make sure you get 16 GB if you want your laptop to last more than a couple of years. Finally, the choice of storage is important. Since the cheaper laptops generally come with a 500 GB hard drive, the only decision you need to make is whether to go for the more expensive, but much faster solid state drive (SSD). Again, it’s about $300 to get a 250 GB SSD from Dell. If budget is a concern, I recommend going with the larger, but slower regular 500 GB drive and upgrading later. Swapping a hard drive for a solid state drive can dramatically speed up a slow laptop a year or two down the road. If you have it in your budget, you can always purchase an after-market 500 GB SSD for around $200 and throw out the drive that the laptop comes with. Doing it right away is going to be easier since you won’t already have a bunch of files on your new hard drive that you need to transfer. Again, make sure you check that your hard drive can be upgraded later if necessary. Some of the smaller portable units cannot be upgraded. If that’s the case, you are best going with a 500 GB SSD for longevity.

Finally, the choice of storage is important. Since the cheaper laptops generally come with a 500 GB hard drive, the only decision you need to make is whether to go for the more expensive, but much faster solid state drive (SSD). Again, it’s about $300 to get a 250 GB SSD from Dell. If budget is a concern, I recommend going with the larger, but slower regular 500 GB drive and upgrading later. Swapping a hard drive for a solid state drive can dramatically speed up a slow laptop a year or two down the road. If you have it in your budget, you can always purchase an after-market 500 GB SSD for around $200 and throw out the drive that the laptop comes with. Doing it right away is going to be easier since you won’t already have a bunch of files on your new hard drive that you need to transfer. Again, make sure you check that your hard drive can be upgraded later if necessary. Some of the smaller portable units cannot be upgraded. If that’s the case, you are best going with a 500 GB SSD for longevity.